34+ what dti do i need for a mortgage

Web Your DTI determines the percentage of your gross income used to pay for your debts and certain recurring expenses. Its HELOCs operate on a 30-year variable term.

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

That means you can only have 43 of your income going to housing and other debt.

. Web 7 hours agoTodays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week. In GOBankingRates Best Banks 2023 survey polling 1000 Americans 33 expect their banks or credit unions to. Web Do you need to borrow money from your bank.

Web Debt-to-income ratio for a USDA loan. Web If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. Web In order to qualify for a jumbo loan at Better Mortgage you need to have a DTI no higher than 43.

Ad Easier Qualification And Low Rates With Government Backed Security. Web A common benchmark for DTI is not spending more than 36 of your monthly pre-tax income on debt payments or other obligations including the mortgage you are seeking. Compare Now Find The Lowest Rate.

So ideally you want to keep yours below that mark. Web What DTI should I aim for. Then divide 1700 by 4500 which equals 378.

Web DTI and Getting a Mortgage When you apply for a mortgage the lender will consider your finances including your credit history monthly gross income and how. This is sometimes known as the. Get A Free Information Kit.

Save Real Money Today. There are two types of ratios the front-end. Web To calculate your DTI add the expenses together to get 1700.

Shared Equity Is A Reverse Mortgage Alternative with Better Lenders Requirements. Web 1 day agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years. Rules differ by lender but most.

But you can qualify for a mortgage with a higher DTI. Free Guide For Homeowners Age 61. Mathematically the formula looks like this.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. That said a lower debt-to. Web So lets say youre paying 500 to debts and pulling in 6000 in gross meaning pretax income.

Are there any exceptions. Web Dividing her total debt payments 2500 by her gross income she has a DTI of 42. Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes.

Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad An Easier To Qualify Reverse Mortgage Alternative. Ad Reviewed Ranked. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house.

Web In general qualified mortgages limit the maximum total DTI to 43. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. In a 52-week span the lowest rate was 445 while the.

Compare Now Find The Lowest Rate. Your DTI is 378. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Web To qualify for a conforming loan most lenders require a DTI of 43 or lower. Better is a family of companies serving all your homeownership needs. 5007501250 6000 042.

As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Divide 500 by 6000 and youve got a DTI ratio of 0083 or.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web A good target for a front-end DTI ratio is below 28 and a good target for a back-end DTI is below 36. To qualify for a USDA loan your backend DTI should be 41 or less with no more than 29 of your income going toward.

Some lenders may accept a debt-to-income ratio of.

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

2 To 4 Unit Home How To Buy A Multi Unit Property

What S A Good Debt To Income Ratio For A Mortgage

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

How To Calculate Your Debt To Income Ratio Rocket Money

Federal Register Qualified Mortgage Definition Under The Truth In Lending Act Regulation Z Seasoned Qm Loan Definition

Buying A House Steps On How To Buy A Home

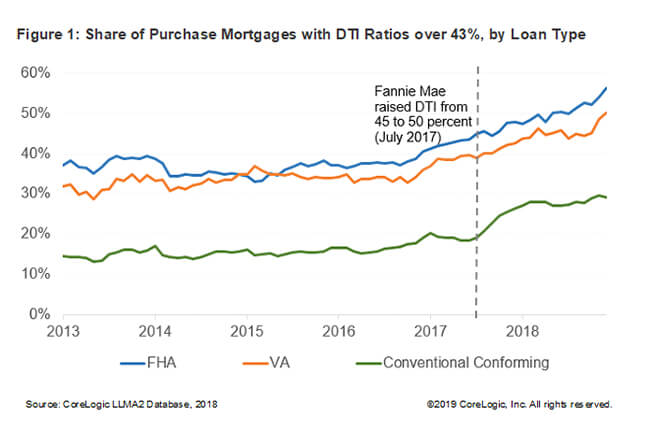

Fannie Mae Will Ease Financial Standards For Mortgage Applicants Next Month The Washington Post

Home Ownership And The Uk Mortgage Market An International Review Institute For Global Change

Dti Ratio What It Means For Your Mortgage And 5 Ways To Improve It First Home Mortgage

What S An Ideal Debt To Income Ratio For A Mortgage Nesto Ca

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

Credit Faq How The New Qualified Mortgage Rule Could Impact U S Rmbs S P Global Ratings

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

Expiration Of The Cfpb S Qualified Mortgage Gse Patch Part 2 Corelogic

How To Calculate Your Debt To Income Ratio Rocket Money

What Debt To Income Ratio Is Needed For A Mortgage Tally